It’s a story that’s becoming more frequent.

A phone call to 911. A relatively young man in his 40s is rushed to the hospital with pain in his chest.

He has high blood pressure, clogged arteries, and blockages in his heart.

The doctors rush him into cardiac surgery.

The surgery is successful, but the patient is now shocked to hear a new diagnosis: Type 2 Diabetes.

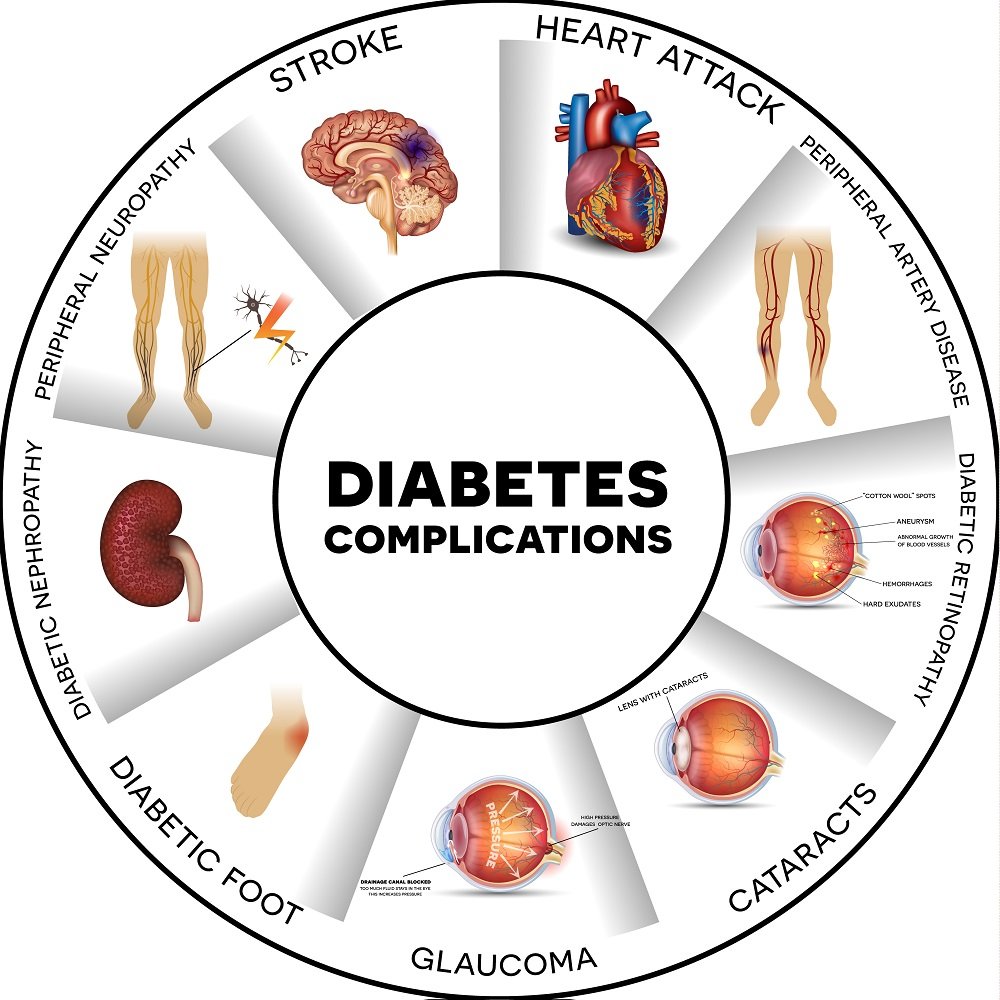

Diabetes is the root cause that gradually contributed to the damage of his heart possibly for years.

Recovery is possible. He’s going to live. But life will not be the same.

A new reality sets in: To live means consistent diabetes care.

The Disturbing Rise of Diabetes

My concern is deepening as I see the rise of diabetes.

According to the CDC, in the last two decades, diabetes has significantly increased among US adults, claiming over 11% of the US population. Moreover, 8.7 million people who have diabetes have not been diagnosed and do not know they have it.

Though I’m not a doctor, I’m beginning to wonder if diabetes (and gut health) will become the new “cancer” rising to the forefront of medical concern as it secretly damages organs, causing widespread symptoms and sometimes even a life-threatening scenario.

As a health insurance broker committed to helping businesses find healthcare solutions for their employees, I want to share with you some ways you can promote diabetes care and prevention for your employees.

The increase in cases of diabetes not only impacts the health of your employees but also increases your company’s healthcare costs. I often tell employers that the best way to reduce healthcare costs is to encourage employees to seek care early. Providing access to good quality care will reduce your medical expenses and therefore lower your premiums.

Diabetes prevention and care is a great place to start in reducing your medical costs while also contributing to your employee’s well-being and health management.

Educate Employees on Diabetes Prevention

Most insurance carriers provide programs for both diabetic prevention and management.

As an employer, you may consider promoting Diabetes Prevention Programs (DDP) to your employees with a printed flyer or email with information on the services and benefits covered by your plan.

With prediabetes, action is the best medicine.

For those eligible with prediabetic conditions, employees should take advantage of the education and support already provided by your plan to maintain healthy eating habits, incorporate more exercise, and raise awareness to better monitor risk factors.

When a person is diagnosed with Type 2 Diabetes, it can be very overwhelming to contemplate a life of ongoing care. Insurance carriers normally assign a case manager to help with diabetes management, and some companies provide a no-cost meter. Many educational programs are available through online wellness resources and carrier apps.

Insurance agents have access to flyers and online resources you can pass along to your employees.

Consider Other Diabetes Care Plans

An additional service you may want to consider would be the Diabetes Management Program with Teladoc Health, which is recognized by the American Diabetes Association for effective self-management diabetes education.

According to their employer’s guide, Teladoc Health recommends that effectively managing diabetes requires a personalized holistic approach that goes beyond a diet.

With their holistic approach to addressing a wide range of chronic conditions, they claim that by comparing their results in five years to other programs, they enroll a broader base of people with chronic conditions and achieve better outcomes overall.

Look for programs that have clinically sound strategies with a personalized holistic approach to diabetes management.

Promote Healthy Habits

As an employer, I know you share my concern regarding the risks associated with the increasing prevalence of diabetes and its potential impact on the health of your workforce. The thought that these conditions might remain unnoticed for an extended period is disconcerting.

Nevertheless, we can be encouraged by the abundance of resources available that offer sustainable outcomes for our employees.

With the new year motivating people to make healthy choices, take this opportunity to educate your employees and encourage them to take advantage of the benefits already covered in your health plans.

To learn more about how you improve your employee health benefits, check out my book on Amazon: The CEO’s Guide to Buying Health Insurance.