Focused on small businesses with 20 to 300 employees

We are Americans, we find ways around obstacles, it is our heritage, what made this country great.

ACA/Obamacare has become a major obstacle for small businesses. Let me explain. The health insurance premiums for small businesses within the ACA/Obamacare health insurance plans are based on all the people in a geographical area on the same plan. It does not matter what the health of a person within the group is, the price is the same for everyone. Everyone the same age on the same policy pays the same price.

The health insurance carriers must price these plans to cover their expected claims.

How do you know if your company is in an ACA/Obamacare plan? If you have less than 50 employees and are fully insured, you are in an ACA/Obamacare plan. Small group fully insured plans are regulated by the ACA/Obamacare law which requires premiums to be set by geographical area.

How do you know if you are in a fully insured policy? If your health insurance broker has not talked to you about level or self-funded plans, you are in a fully insured plan.

What is a level funded plan and how does it avoid ACA/Obamacare rules? Self-funded medical plans are not subject to most state insurance mandates or state insurance-premium taxes. They also are not subject to the fully insured ACA/Obamacare funding structure.

Level funding is simply a financial structure inside the health insurance policy. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. In other words, it breaks down the fully insured policy while creating the same look and feel to the company and employee. It’s not quite this simple, your NextGen agent can provide you with the details. It is how the large corporations have structured their benefits for years.

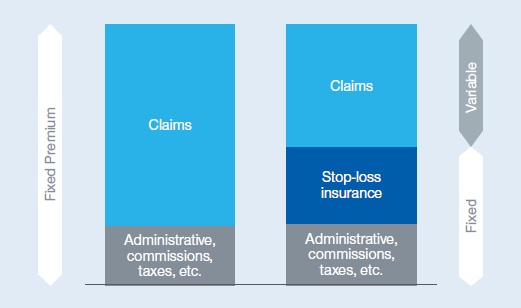

On the fully insured plans, a small business pays a fixed premium to an insurance company. The insurance company then pays healthcare claims, administrative costs, sales commissions and taxes.

If the healthcare claims are higher than expected, the insurance company covers them. If the claims are lower than expected, the insurance company keeps your money*.

Level funded plans are priced based on your company’s expected claims, plus the administrative costs and stop-loss insurance. Throughout the year, you will have reports showing you your company’s claims cost. At the end of the year, after the claims are reconciled, if there are claims dollars remaining, a previously agreed payout agreement will be enacted.

*ACA/Obamacare requires health insurance companies to refund proportionately, premium dollars collected in excess of 80% of the total claims paid in a geographic area on the same plan.

Information in this article was obtained from United Healthcare’s All Savers® Alternate Funding Traditional Plans, Small Business Self-Funded Health Plans. 8/18